Korean loans are increasing significantly.

"If there is a household debt crisis in South Korea, corporate debt caused us to have a currency crisis back in 1997, which would be tens of times more powerful" - Presidential chief of staff. Recently, as mentioned by Presidential Chief of Staff Yoon Suk Yeol, household loans are currently increasing and the delinquency rate for household loans is also increasing. The problem is that household loans are increasing very rapidly. In addition, household loans are being made for real estate investment purposes, not livelihoods, which is becoming a bigger problem. Let's find out how serious the current household debt problem is and what causes the household debt problem and the rising interest rates in the United States related to Korea's household debt.

Household loan situation: How much has household loan increased?

The risk of household debt is considered through a number of aspects. The degree of risk of household debt is judged through the absolute size of household debt, the trend of increase or decrease in how much it increased in the short term, and household debt relative to the income earned by oneself. In all three aspects, Korea's household debt has already crossed the red line. According to the banking sector as of November 1, 2023, household loans from the five major banks (KB Kookmin Bank, Shinhan Bank, Hana Bank, Woori Bank, and NH Nonghyup) amounted to 686.11 trillion won as of the end of October, an increase of 3.6825 trillion won in a month compared to 682.3294 trillion won at the end of September. Household loans from the five major banks have continued to decline for 16 consecutive months since January 2022, and have continued to increase for six consecutive months from May to October 2023. The problem is that last month's increase in household loans was the highest in the last six months. The increase in household loans was 143.1 billion won in May, 633.2 billion won in June, 975.4 billion won in July, 1.5912 trillion won in August, and 1.5174 trillion won in September, but it jumped to 3 trillion won last month. In addition, household debt to gross domestic product (GDP) accounts for 105%. GDP per capita refers to the total amount of value produced economically by a person and is mainly an indicator of the national economic standard of living. In other words, the fact that the ratio of household debt per capita exceeds 100% means that the debt of individuals or households is greater than the production value per capita. This indicates that all debts cannot be repaid in the same year with the income earned by an individual in the year. In addition, the household light delinquency rate in the second quarter of 2023 was 0.58% in the youth sector, up 0.17%p from a year ago. As such, the household debt problem is getting serious.

Why Household Loans Increased: Real Estate

The reason why household loans are currently increasing significantly is by far due to real estate. The high price of houses that took place in 2020 still seems to be causing people to see real estate as a means of investment. Youngchljok (who borrowed the most money to buy a house) has emerged as a big hand in the Seoul apartment market since 2020. In addition, the average price of a 30-pyeong apartment in Seoul in January 2020 was 1.14 billion won, up 78% from May 2017 (640 million won). Real estate investment, which has brought such a large profit, is still in its aftermath. The current interest rate is also high, but the reason why people buy real estate with debt even though it is expected to rise in the future is that they think housing prices will rise further. The reason for the sharp rise in household loans was that 50-year mortgage loans had a big impact. A mortgage loan refers to a loan that receives a house as collateral, such as a private house or apartment, and a 50-year mortgage loan refers to a product with a maturity of 50 years. The biggest factor in the expansion of household loans from the five major banks in October is mortgage loans. The five major banks' outstanding mortgage loans stood at 521.2264 trillion won as of the end of October, up 3.3676 trillion won from 517.8588 trillion won at the end of September. Mortgage loans have also been on the rise for six consecutive months since May. Under pressure from financial authorities, banks have virtually stopped selling 50-year mortgages and are raising interest rates on loans, but demand for household loans is on the rise. Some analysts say that the financial authorities have announced that they will introduce stress DSR, a means of regulating loans, within this year, driving demand to get on the "last train" of mortgage loans. The first feature of a 50-year mortgage is that 50-year products are less burdensome than 30-year products in the way that principal and interest are evenly repaid. Since principal and interest are slowly repaid over 50 years, the immediate charges will be much smaller than 30-year products. There is also an increase in the amount available for loans. Among the current loan regulation policies, there is a loan DSR (total debt principal and interest repayment ratio). It is a policy that allows loans up to a certain percentage of the money that pays off the debt from one's annual salary. This 50-year maturity allows more money to be borrowed because the amount of money paid immediately decreases even if DSR regulations are applied. However, in terms of the total contribution, 50-year products are much larger because of the interest burden. Therefore, as maturity increases, the amount of loans available increases and interest is borne more. 50-year mortgage loans have been so popular that they hit 1.8 trillion won in April 2023, 3.6 trillion won in May and 6.4 trillion won in June since their launch. The reason is to wait for the house price to rise without paying it back by completing the 50-year maturity, and then sell it and repay it when the house price rises. This is because it is expected that the increase in house prices will be greater than the interest burden. It is also due to the large amount of loans given to 50-year mortgages. The government's successive real estate deregulation policies affect the background of the sharp increase in household loans, especially mortgage loans. In fact, in a parliamentary audit of seven financial and public institutions held on October 24, 2023, people pointed to 50-year mortgage loans and special home loans as the main culprits of the increase in household debt. First, the mortgage loan ratio (LTV) was relaxed. The mortgage loan ratio (LTV) refers to the ratio of the loan amount to the price of the collateral (housing) when lending from a financial institution with a house as collateral. For example, if the house price is 200 million and the mortgage loan ratio is 70%, the maximum amount of the loan reaches 140 million won. The purpose of this policy is to limit loans below a certain percentage of housing prices in consideration of auction bids and real estate prices so that the recovery amount is not less than the loan amount when mortgage loans fail. For the second time, government launched a special nesting loan. The special nesting loan is a policy mortgage product introduced by the government on January 30, 2023 for those who do not have a home, and is a system to support those who are unable to find a home due to the soaring housing prices. The special nesting loan covers houses of less than 900 million won and provides loans of up to 500 million won for up to 50 years at a low interest rate of 4% per year. However, in the real estate market, it is analyzed that housing purchase has decreased as interest rates on commercial banks' mortgage loans have risen to the 7% range per year. In addition, as financial authorities are recently tightening household loans and bank financing costs are increasing due to high interest rates, housing purchases are expected to decrease further as interest rates are expected to rise further. COFIX, the basis for the variable interest rate on mortgage loans in the banking sector, rose 0.16%p (point) from the previous month to 3.82% last month, the highest for the year. According to the financial sector, as of the 17th, the fixed interest rate on mortgage loans (five years of gold loan rights) of the five major commercial banks, including KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup, was 4.14~6.584%. The variable interest rate is 4.53 to 7.116% per year, already exceeding 7%.

Problems in Increasing Household Loans

So what are the problems when household loans increase? Household debt is personal and household debt, mainly including mortgage loans, credit card loans, and consumer finance. The first problem with the increase in household debt is that the financial burden increases. When household debt increases, the financial burden of interest and principal repayment increases, and as household debt accumulates and delinquency rates increase, insolvency of banks such as banks that lend money can lead to bankruptcy. In addition, if household debt continues to increase, financial instability may grow and consumption and investment may shrink.

The government's policy

As household debt increases, the presidential office and the government decided to improve the proportion of high variable-rate loans first to improve the vulnerability of household debt exposed to high-interest rates. As mentioned earlier, the DSR (Debt Service Ratio-Total Debt Repayment Ratio) policy regulates the amount of loans available. DSR splits all one's debts to annual income by annual principal and interest and regulates the ratio not to exceed the set percentage so that they can receive less loans. As previously introduced, variable interest rate stress DSR emerged to prevent such DSR from being avoided through 50-year mortgage loans. In order to reduce the proportion of variable-rate loans, the government has decided to quickly introduce a "variable interest rate stress DSR" that applies a certain level of additional interest rates when calculating DSR. Variable interest rate stress DSR is a regulation that applies variable interest rates to increase the amount of principal and interest to be paid back when interest rates rise, and this standard is also applied to further reduce the amount of loans that can be borrowed. In other words, the policy is to reduce the limit of loans that can be borrowed by calculating that you pay more interest on additional interest rates when calculating the DSR ratio. Fundamentally, it is necessary to block excessive buying of a house in a high-interest rate situation by dampening expectations that housing prices will rise. While Seoul and the metropolitan area are leading the rise in housing prices, the government should ease redevelopment and give a signal that housing prices will not rise by giving the province a signal that new housing will be supplied. Overall, housing prices are rising mainly in Seoul and the metropolitan area, and housing prices should be prevented from rising by increasing redevelopment or reconstruction to signal that new housing will be supplied to the core areas of the metropolitan area.

U.S. interest rate situation

|

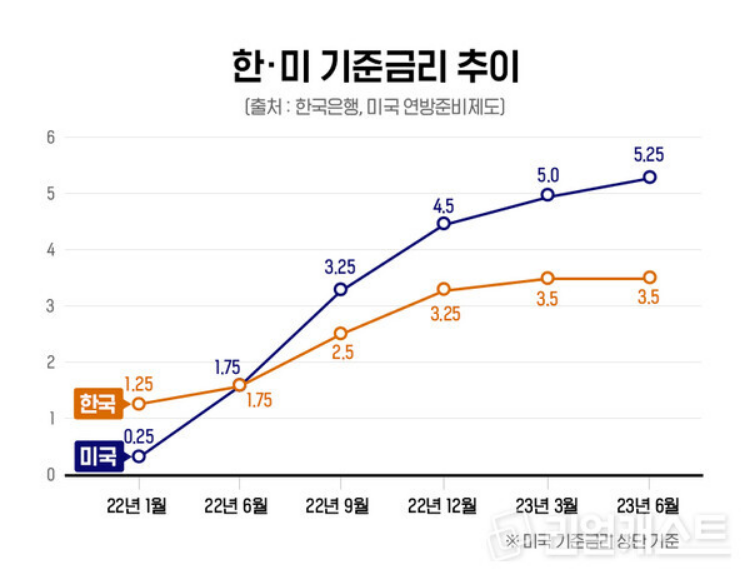

U.S. interest rates are very important to observe because they have a great influence on economic conditions such as the Korean stock market and interest rate market. Currently, Base Rate is frozen at 5.5% in the U.S., and the U.S. 10-year Treasury bond is rising. If interest rates in the United States rise, domestic interest rates rise, and of course, mortgage interest rates rise. The reason is explained in stages as follows. In November 27, 2023, FOMC (Federal Open Market Committee) CONFERENCE Announces Freezing U.S. Base Rate To 5.5%. The Fed aggressively raised interest rates for the 10th consecutive time from March 2022 to May 2023, with the goal of catching the worst inflation in 40 years, before freezing them at 5.5% for the first time in 15 months in June. Our focus is December and further forward. The U.S. interest rate can be divided into a base rate and a market rate. Interest rates are interest accrued on lent money or deposits. Here, the base rate is a policy rate representing a country's interest rate and can be viewed as the interest of commercial banks. If the base rate is raised, the interest rate of commercial banks will rise together, and if the base rate is lowered, the interest rate of commercial banks will also fall. It is the interest rate set by the Fed and is set by the Bank of Korea in Korea. Then, what is the relationship between the US interest rate and Korea's interest rate? If the U.S. interest rate is higher than the Korean interest rate, foreign investors stop investing in Korea and recover the capital to move the capital to the U.S. It is dangerous if there is a large difference between the US interest rate and Korea's interest rate. Therefore, as the US raises the base rate, Korea also tends to raise the interest rate. The market rate is the 10-year U.S. Treasury yield. The 10-year U.S. Treasury yield is a government bond issued by a U.S. state and is issued for the purpose of financing and has a maturity of 10 years. Stocks are highly risky when investing, while U.S. government bonds are a representative safe asset. Therefore, if the economic situation is expected to deteriorate, there will be a movement of funds from speculative assets (stock) to safe assets (government bonds). On the other hand, if the economic situation is expected to improve, the price of government bonds will rise. In addition, when demand for government bonds decreases, government bond prices fall and government bond rates rise. What should be noted here is the inverse relationship between government bond prices and interest rates. This means that if interest rates on government bonds rise, government bond prices fall. Simply, it means that the government should guarantee a high rate of return (=high interest rate) through government bonds to lose popularity enough to buy (=price drop). Currently, the interest rate on the 10-year U.S. government bond has been raised to 5%, which means that government bond prices have fallen and interest rates have risen due to falling demand for a combination of reasons. Currently, the 10-year U.S. Treasury yield has surpassed 4.9% per annum for the first time in 16 years. What does the 10-year U.S. Treasury yield (market rate) have to do with Korean interest rates? The reason why the dollar did not escape from Korea despite the difference of 2%p between the U.S. and Korea's benchmark interest rates was that it remained in Korea based on the market interest rate (the early 4%p), not the U.S. benchmark interest rate. This is because the U.S. market interest rate is almost the same as that of Korea. Therefore, if the 10-year U.S. interest rate rises, Korea's economic situation is also expected to become dangerous. In summary, bond rates have surged (bond prices have fallen) and the stock market has been sluggish due to the prospect of high-interest rates sticking in the market. In addition, the rise in U.S. government bond rates is leading to an increase in Korea's lending rates. Economic problems work in a chain just as Korean interest rates and U.S. interest rates are linked, and interest rates are linked to bonds. Even if the difference between the U.S. benchmark interest rate and Korea's benchmark interest rate is large, there is a great concern about Korea's financial instability and economic recession to raise Korea's interest rate without hesitation. In the current situation of serious household debt, we should avoid speculative loans and aim to carefully examine the economic situation and read the flow rather than follow the trend that spreads too fashionably.

장서영 hweqpiy6678@naver.com

<저작권자 © 인하프레스, 무단 전재 및 재배포 금지>

![[보도] 제43대 총학생회 후보자 공청회 개최돼](/news/photo/202404/11686_5015_2626.png) [보도] 제43대 총학생회 후보자 공청회 개최돼

[보도] 제43대 총학생회 후보자 공청회 개최돼

![[보도] 제43대 총학생회 후보자 공청회 개최돼](/news/thumbnail/202404/11686_5015_2626_v150.jpg)

![[보도] 총학생회장 선거 열려···학생사회 대표자는?](/news/thumbnail/202403/11668_5014_266_v150.jpg)

![[보도] 무전공·계열제 논의···학생은 어디에?](/news/thumbnail/202403/11666_5011_2238_v150.jpg)

![[보도] 인하 70돌, 다양한 행사 이어져](/news/thumbnail/202403/11663_5009_165_v150.jpg)